Market segmentation in the construction industry

It is very important for firms to split their clients (or customers) into different segments, grouping together those clients with similar characteristics which have similar needs. This is not simply about size or sectors but more about what services are bought, by whom, and why. The aim is to identify true clients’ needs, which can be combined together to identify the best segments on which to focus marketing efforts.

This process is called ‘segmentation’ and will identify the most attractive and profitable segments and also those with the highest potential for growth.

Operating a market segmentation strategy can offer considerable competitive advantage. Segmentation centres around identifying the best way to distinguish the main sectors an organisation works in within the total construction market. The skill is in choosing appropriate segmentation criteria given the wide range of possibilities.

The criteria must refer to difference in demand by each customer group. For example the needs and requirements of development directors of retailers are different to development directors specialising in commercial office buildings. The features of an organisations range of services benefit different clients in different ways and so organisations must distil the benefits they experience and promote tailored messages to each segment group.

Major segmentation criteria in the construction industry would be:

| Industry segments | Geographical |

|

Private housing |

North Midlands South etc |

Each of the above industry classifications must also be segmented into further categories such as; commercial retail, commercial office or public health, education and private health and private education, etc. The same applies for geographical segmentation such as Midlands into East and West Midlands.

Whilst organisations must clearly segment accordingly to their own customer grouping it is advisable to organise them in such a way that it is possible to layer over data and research findings from industry research bodies to ensure consistency and compatibility. If organisations fail to ensure their segmentation forecasting is based on quantitative research, it will not usually be easy to measure potential segment size, or more importantly, progress. It is therefore critical to recognise that the full implementation of a segmented strategy demands an adequate flow of data for both planning and control purposes.

Without the use of segmentation organisations pursue a homogenous strategy, which may lead to a product or service trying to be all the things to all people. This may work reasonably well when an organisation is dominant, or in a monopoly situation, but it leaves their product or service vulnerable to attack by competitors who target smaller sectors of the market. In time this could mean the 'homogenous' product or service appeals less and less to the total market whose needs are being satisfied elsewhere, and leaves them with fewer potential customers.

This article was created by --Philip Collard 14:48, 10 December 2013 (UTC)

[edit] Related articles on Designing Buildings

Featured articles and news

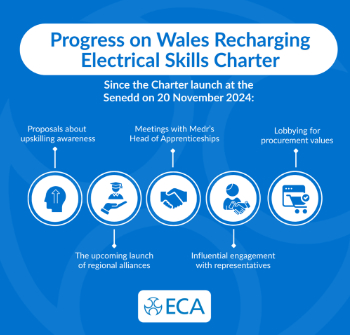

ECA progress on Welsh Recharging Electrical Skills Charter

Working hard to make progress on the ‘asks’ of the Recharging Electrical Skills Charter at the Senedd in Wales.

A brief history from 1890s to 2020s.

CIOB and CORBON combine forces

To elevate professional standards in Nigeria’s construction industry.

Amendment to the GB Energy Bill welcomed by ECA

Move prevents nationally-owned energy company from investing in solar panels produced by modern slavery.

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Heat pumps, vehicle chargers and heating appliances must be sold with smart functionality.

Experimental AI housing target help for councils

Experimental AI could help councils meet housing targets by digitising records.

New-style degrees set for reformed ARB accreditation

Following the ARB Tomorrow's Architects competency outcomes for Architects.

BSRIA Occupant Wellbeing survey BOW

Occupant satisfaction and wellbeing tool inc. physical environment, indoor facilities, functionality and accessibility.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.